The brain behind the blockchain technology might not have anticipated the latest surge in the platform that took root a decade ago. Starting off with Bitcoin, the digital community had been inundated with tasks of sorting positive coins from the lot. At the moment, the lot has fallen on over 1,500 crypto coins to find their place in the decentralized world and with increased fluctuations in their prices; it would be survival of the fittest as they seek to outsmart the other.

Pundits are of the opinion that current crop of decentralized exchanges have not actually met pain points. BitcoinBing was developed as solution to that downside but the mantle on its shoulders is one too many as it hopes to provide viable trade experience. The exchange rooted by BitcoinBing is one its developers believe would re-tell the story of decentralized exchanges. It would therefore suffice to look at some of these issues.

Downsides in Crypto Exchanges:

Though available exchanges were premised on the blockchain making them secure and free from intermediary and external financial influence, their lags and unprecedented challenges are one too many. Being the last hope of cryptographic currencies, their limited scale might make or mar success stories of these currencies.

Traders are not pleased with dictated prices on different currencies – a development they believe is targeted at shortchanging them. It therefore seems the goal of crypto exchanges were lost in transit of profit-making given the fact that they were hurriedly development thereby leaving out many infrastructures that could have facilitated transactions.

Regrettably, available exchanges have little regard for traders’ complaints because no measures were put in place to attend to their questions and complaints when the need arises. Since transaction fees remain channel for most exchanges’ income, there are records of hiked fees – a situation that does not go down well with traders. Challenges in the system abound but mention must be of its centralization. Perhaps in obvious disregard for what the blockchain stands for, some exchanges were tailored to suit the needs of certain geography without considerations for external participants that might want to hop in.

.jpeg)

Dining with BitcoinBing:

Cropped from the earliest crypto currency, Bitcoin, BitcoinBing is restoring the past glory of the blockchain and the essence of cryptographic currencies as borderless currencies. Thus, the exchange that is touted to be vibrant than existing ones will not only hedge downsides but also extend its frontiers to the corridors of traders who might have been disenfranchised by high costs and limited geography of current exchanges.

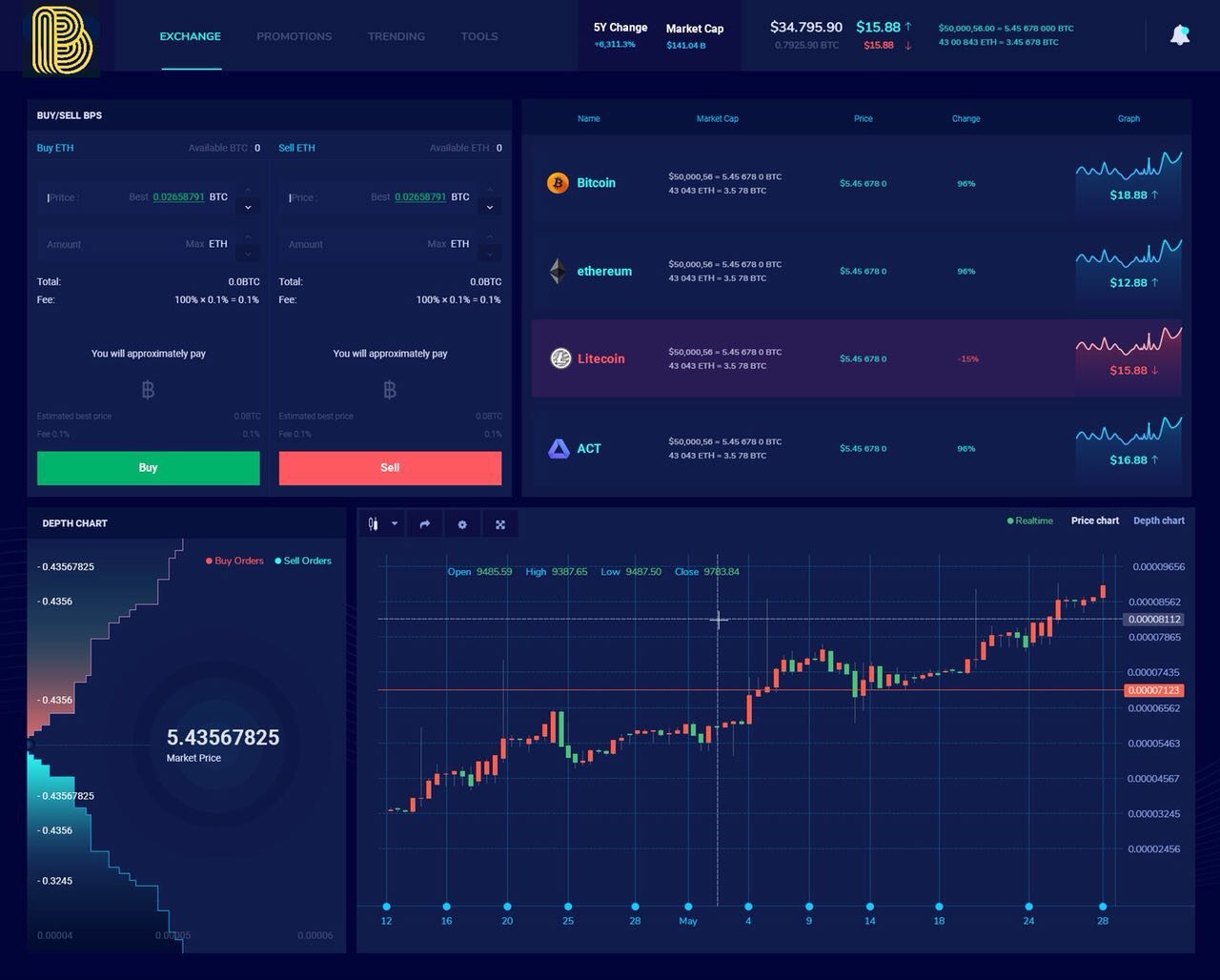

Viable Exchange is Attainable with BitcoinBing:

As its input to the success of cryptographic exchanges, BitcoinBing had delegated enough resources towards improvement of infrastructures. Thus, the exchange will pull off traders from queuing up for transaction confirmation. To this end, there are enough infrastructures to handle about 1 million orders on second-basis. As sweetener added to a wine, the exchange has in-house features for maximum trades such as margin trading and decentralized exchange.

.png)

Perhaps the hay days when exchanges called the shots of transaction rates might be relegated to crypto oblivion by this exchange. The idea is that traders will put coins in their kitty up for sale at their pre-determined rates and investors can bid for a cut-down and purchase when negotiations had been made.

Similarly, trust is optimum as the exchange has user ratings where traders will be rated by investors based on their interactions. This move is expected to give parties insight to the other’s personality. Interestingly, transactions are not fiat – from trader to investor. There’s a smart contract to regulate and hold funds. Thus, a trader cannot get hold of an investor’s fund till he fulfills his part of the transaction.

Full Stack Trading:

Most times, crypto traders render complaints of its volatility and this is perhaps because of their inaccessibility to parameters for effective trades. BitcoinBing brings to the table full stack trading as means of intimating traders with needed tools of scaling transactions.

Crypto risks will be at bay because the full stack trade desk functionality provided by the exchange avails calculators that compute the end-point of a trade. The computation also extends to calculation of available assets and profits they can yield. These parameters are plots to reduce increased losses recorded in recent times on digital assets.

Mobile Carriage:

Taking a long walk and being a lone ranger in exchange formation, BitcoinBing had joined growing list of exchanges that have taken root in mobile devices. Plans are underway to develop similar interface as its desktop’s for mobile devices running on the Linux, Android, iOS and Windows operating systems.

Multiple Currency-Pairs:

The exchange had in its bid to scale transactions and accommodate growing needs for crypto romance with fiat counterparts, allows pairing of supported cryptos with fiat currencies. The door is also open for other cryptographic currencies to forge pairs with others.

BitcoinBing – User-Centered Exchange

Mention had been made of the exchange’s support of multiple trading pairs and its risk-hedge. There is however other impressive features that stands it out from the crowd such as compilation of crypto information. This will feature in last-mile permutations and help users reach decisions before taking leaps into trades.

While it extends its frontiers to persons outside its region, BitcoinBing has in stock necessary tools that allow participation across regions such as its support for multiple languages.

In a nutshell, the exchange is no doubt, the first user-oriented haven put in place tools that will enhance users continuous of the exchange. To back tis up, there is customizability that allows users specify changes they would like to see on the exchange. This in no small measure, increases users’ participation, includes them in governance and provides room for them to have relevant features that will positively buoy their trades.

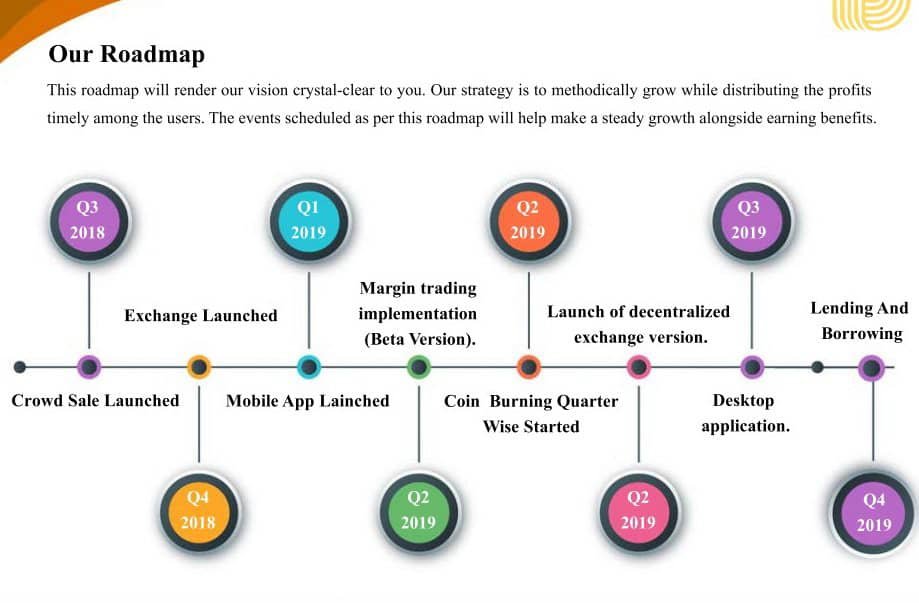

Roadmap :

Token Distribution

Marketing: 50%

Partnerships: 10%

Team: 20%

Legal and Compliance: 10%

Development: 10%

Token Sales Information

.jpeg)

Ticker: BING

Platform: Ethereum

Token Supply: 1 billion

Exchange Rate: 1 BING= $0.5 USD

Soft Cap: $4 million USD

Hard Cap: $40 million USD

Accepted Currencies: BTC, ETH

Registration Country: Estonia

Restricted Area: The USA

Meet the experienced and devoted Team behind Bitcoinbing :

.jpeg)

Bitcoinbing Ambassadors:

.jpeg)

USEFUL PROJECT LINKS FOR BITCOINBING

Website: http://www.bitcoinbing.

Telegram : https://t.me/bitcoinbing

Facebook: https://www.facebook.com/Bitcoinbing-228650464472887/

Twitter: https://www.twitter.com/BingBitcoin

Reddit: https://www.reddit.com/user/BitcoinBing

LinkedIn: https://www.linkedin.com/company/bitcoinbing

Youtube channel: https://www.youtube.com/channel/UCaTG55raZfSnHOSRS4zNQ3A

Instagram: https://www.instagram.com/bitcoin.bing/

Medium: https://www.medium.com/@bitcoinbing

BITCOINTALK PROFILE NAME: DEWI08

WALLET ADDRESS (ETH): 0x53D1Ea8619E638e286f914987D107d570fDD686B

Tidak ada komentar:

Posting Komentar