ABLE PROJECT: DECENTRALIZED CRYPTOCURRENCY PLATFORM

The ABLE project has been proposed to provide an alternative to banks’ conventional lendingdeposit spread structure, and to solve problems with initial cryptocurrency banking services.

1) Banks have a business model based on a lending-deposit spread (i.e., the difference between lending and deposit interest rates), in which the bank acts as an intermediary between depositors and borrowers. This structure allows banks to receive deposits at low interest rates and lend money at high rates, profiting from the difference.

2) Existing cryptocurrency-based banking services are provided through a centralized structure. The combination of unsustainably high interest rates and centralized services renders banks directly vulnerable to managers’ moral hazard and the hacking of central servers. The lack of integrated solutions in the crypto market withholds users from experiencing diverse banking services.

VISION

The ABLE project will create a solution to problems with traditional bank lending-deposit spreads, and nontransparent and centralized cryptocurrency financial services, basing the solution on the transparency and reliability of a blockchain system. The ABLE project is the cryptocurrency-specific financial solution that provides cryptocurrency financial products through person-to-person loanmatching systems and decentralized exchanges.

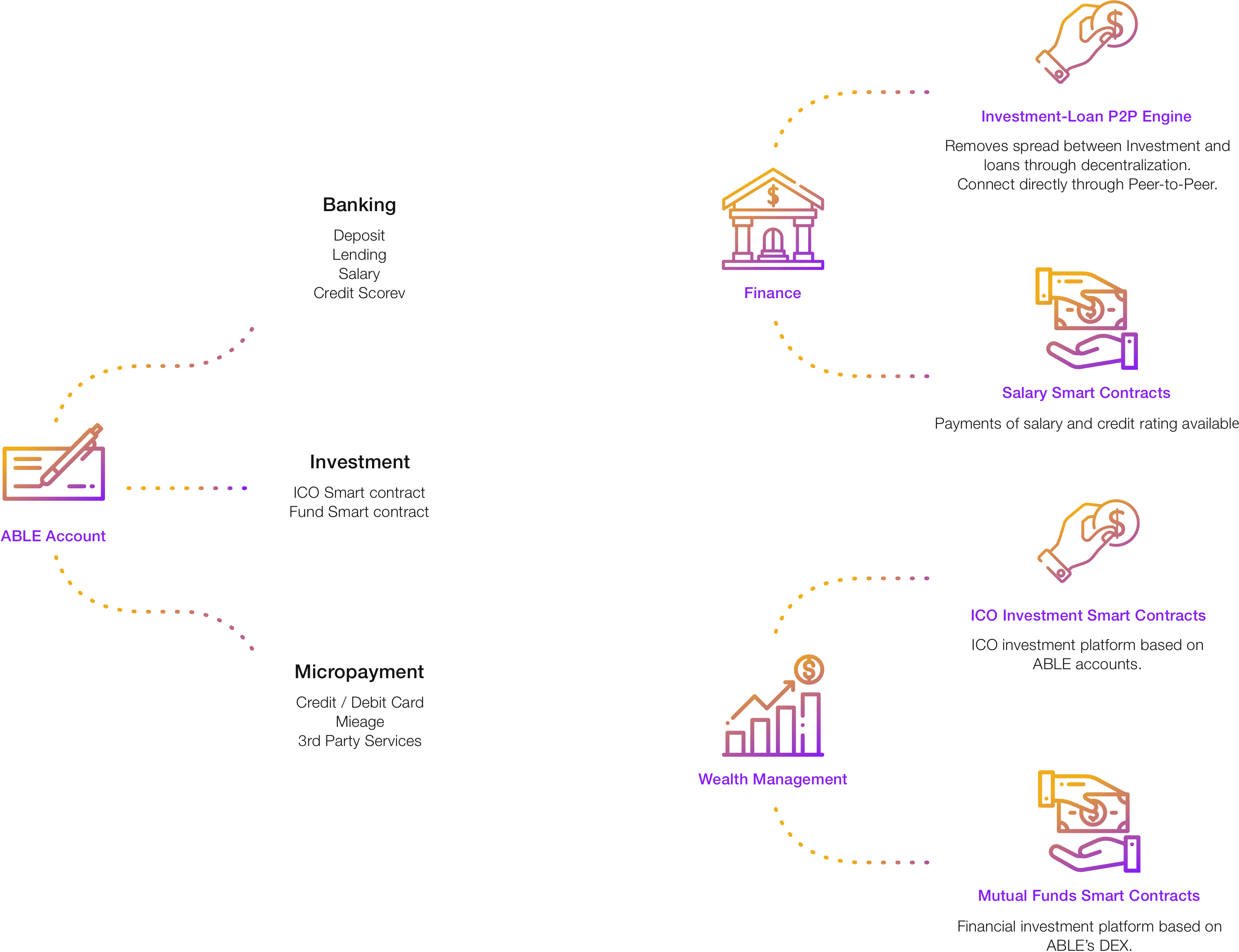

The ABLE project will create a platform that enables cryptocurrencybased financial activities to center around the ABLE account, emanating from the fact that banking activities are carried out primarily through bank accounts. Users propose loan interest rates through a matching system, eliminating the lending-deposit spread by directly connecting users on a peer-to-peer basis. The ABLE project supports decentralized exchanges and provides decentralized cryptocurrency wealth management services through smart contracts. Ultimately the project aims to evolve into the ABLE Ecosystem through its integration with external systems, including simple payments.

BACKGROUNDS

Traditional banks serve as intermediaries and profit from differences between deposit and loan markets (lending-deposit spreads). The ABLE project will create a system that enables investors and borrowers to share the value generated by eliminating such intermediaries. Currently, cryptocurrency banking businesses provide piecemeal services such as high-yield deposits and loans involving intermediary risks. The ABLE project creates a sustainable business model that enables direct account-based linking of users through smart contracts, and through decentralization solves the problems of managers’ moral hazard and the hacking of central servers.

ABLE PROJECT: FINANCIAL SERVICES

The ABLE project, in its initial stages, provides:

1) investing/lending

– investing-lending matching engine;

2) payroll and credit score/ loan

– cryptocurrency salary- payment service and credit scores to support loans;

3) simplified payment and remittance service

– simplified account address service and reserve remittance; and

4) investment

– account-based Initial Coin Offering (ICO) investment governed by a smart contract.

The project offers an account-based finance experience that encompasses, loans, remittance, payroll, and investment.

ABLE ECOSYSTEM DEVELOPMENT PLAN

The ABLE Ecosystem largely comprises the ABLE account and support for third parties providing finance, wealth management, and micropayment services. We will add the decentralized exchange (DEX) feature to store smart contracts based on various cryptocurrencies. Operating on DEX, we will distribute the framework to allow production of wealth management and finance smart contracts, creating an environment where a wide array of product developers can develop financial products. Thus, users can access a variety of financial products, and through API development the ABLE project can evolve into a cryptocurrency finance platform and an ecosystem enabling communication, including micropayment, with outside parties.

1. ABLE SYSTEM ARCHITECTURE

Users can use the ABLE account to access third-party services including micropayment, investments, loans, and wealth management. This strategy allows existing bank-account users engaged in financial activities to expand their services in more accessible ways. We aim to provide users with financial services integrated around accounts.

2. ABLE Account

All the services of the ABLE system will operate on smart contracts based ABLE User and ABLE Account. The ABLE User can have one or more ABLE accounts, depending on the purpose. The ABLE User data includes user information, a list of accounts held, fund/loan subscription details, payment history, and creditworthiness. The ABLE Account encompasses deposit account, loan account, collateral account, free account, fund/finance account, and credit score. Each ABLE Account includes account information, account holder, account number, password, e-mail address linked to the account, account type, deposit coin, and balance. Upon creation of the ABLE account, the user can transfer and withdraw money through the ABLE free account, and utilize various products based on smart contracts.

ABLE CRYPTOCURRENCY ECONOMIC SYSTEM

1. ABLE COIN/ABLE DOLLAR

ABLE currency consists of ABLE Coin and ABLE Dollar. ABLE Coin is used as a service charge for using the ABLE system, and ABLE Dollar is used for interest payment. ABLE Coin and ABLE Dollar can be exchanged.

2. ISSUING ABLE COIN/ABLE DOLLAR

The amount of ABLE coins initially issued is 25 billion, and the token decimal unit is 18. Validation nodes will be operated on a PoS basis. The additional inflation rate through initial PoS-based operation is 15%, which will converge into 5% in the long run. Of the outstanding tokens, 15 billion will be distributed to the general public and 10 billion will be assigned to related parties. The initial amount of ABLE Dollar issued is 1 billion. To ensure minimum volatility, no additional ABLE Dollar will be issued.

3. ABLE CONSENSUS PROTOCOL

ABLE adopts the PoS consensus protocol. The minimum number of ABLE coins preserved to operate validation nodes will be 20 million.

TECHNICAL STRUCTURE OF ABLE SYSTEM

The development of ABLE system goes through three stages. At the first stage, we first develop ABLE account, investing-lending matching, and convenient cryptocurrency address services through solidity-based ABLE smart contract technology on the Ethereum blockchain and then provide ABLE service through the ABLE web page. At the second stage, we develop ABLE DEX and design various ABLE financial products that interact with ABLE smart contracts and provide them to users through the web page. At the final stage, we create a dedicated blockchain main network for ABLE that allows us to provide credit services and personalized financial products by gathering and analyzing user patterns of using financial products

ARCHITECTURE OF ABLE SYSTEM

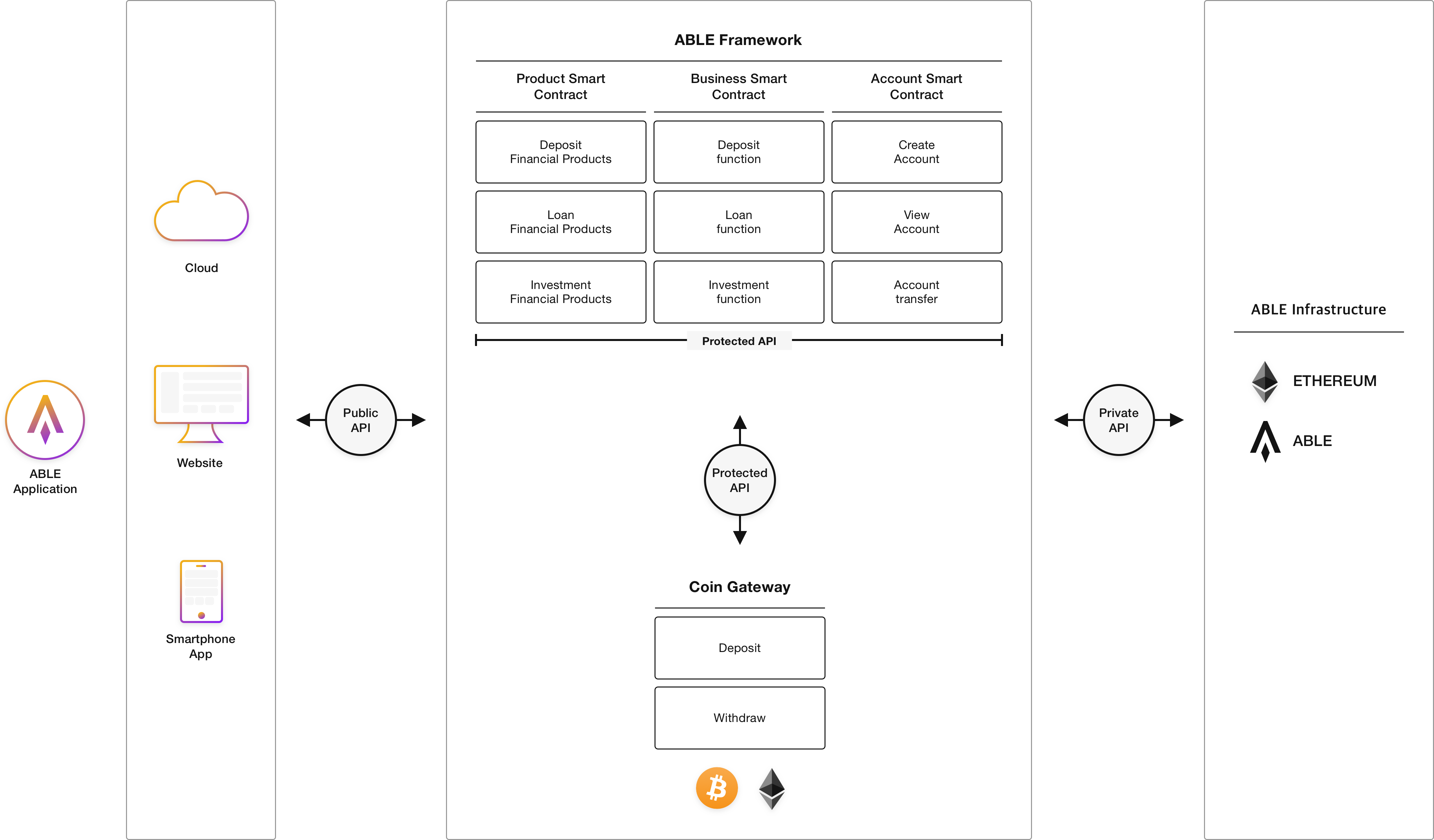

The ABLE system has the following architecture: it is made up of infrastructure layers, ABLE framework layers, and application layers, and members have limited access to the respective layers depending on their access level.

1. INFRASTRUCTURE

The layer consists of blockchain systems for managing shared log and executing smart contracts. In the initial stages of the ABLE project, Ethereum blockchain will be used and then replaced by dedicated ABLE blockchain. In the infrastructure layer, ABLE accounts, investing-lending matching engines, the DEX, and cryptocurrency gateways are designed, forming the foundation of the ABLE system. Access to the infrastructure layer is limited to the ABLE system, but the layer is maintained and repaired at the request of users.

2. ABLE FRAMEWORK

The framework provides cryptocurrency gateways and the DEX to allow for exchange of cryptocurrencies between different blockchain systems and offers finance solutions for investinglending matching engines and ABLE products. Smart contracts of ABLE financial products are designed based on their characteristics. Access to the framework layer is limited to the ABLE system which validates and distributes such financial products.

3. ABLE APPLICATION

The application introduces how to transfer money, create an account and use products designed based on smart contracts and delivers user requests to the framework. Using account smart contracts, users can create their own ABLE account, transfer money, and use financial products through distributed product smart contracts. The application layer provides web sites and smartphone apps for users to easily use the ABLE system. Access to the application layer is also given to users, and they can access the ABLE finance and financial products through the web and applications.

BUSINESS MODEL

The ABLE project is largely composed of ABLE User, Contributor, and Master-nodes. The user can use financial services, investment products, payments, and a variety of services. The contributor produces a wide array of services including finance, investment products, and payment that the user can utilize, and receives service charges. The master-nodes ensure stability in operating a decentralized ABLE network based on PoS consensus algorithms, and receive networktransaction service charges.

History and financial instruments are achieved by Ethereum smart contracts.

1. ABLE Application

User can retrieve and utilize financial instruments through the ABLE Application. ABLE Application runs on both web and mobile UI.

2. ABLE Structure

Smart contracts including Investment, loans, mutual funds, and profit distributions can be designed on the ABLE Framework. Various smart contracts can be browsed and registered through the ABLE Application(Web/Mobile).

3. ABLE API

ABLE system adopts the layered architecture, and permission levels will be determined according to each layer. Each layer and component can communicate via standard API’s. Pairs of API permission levels and users match Public - User, Protected - Administrator, Private - System Developer.

4. ABLE Ethereum Infrastructure

Initially, ABLE Project will run on Ethereum, utilizing a cryptocurrency gateway and blockchain systems. ABLE Main Net will be launched to reinforce banking/fund/payment systems.

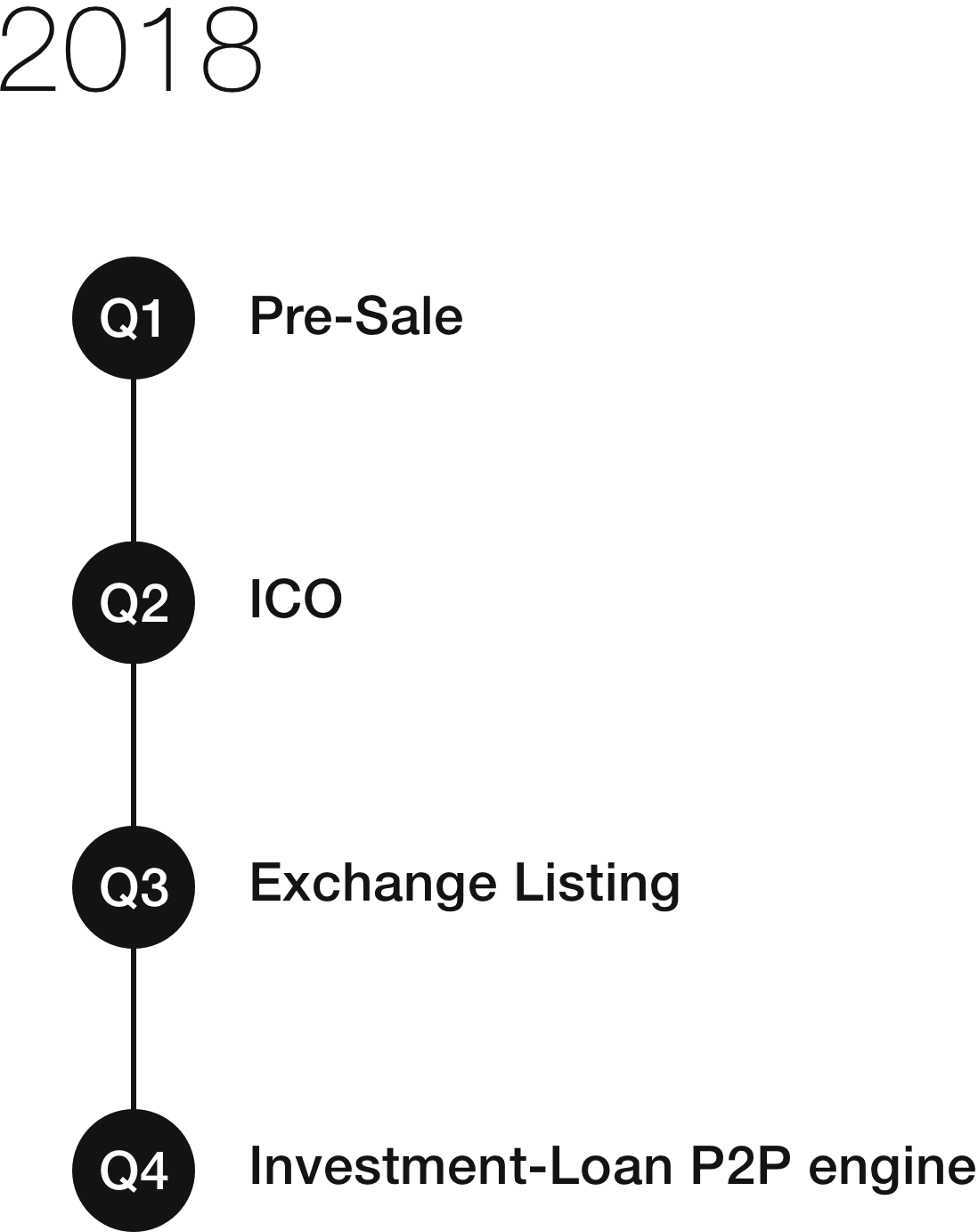

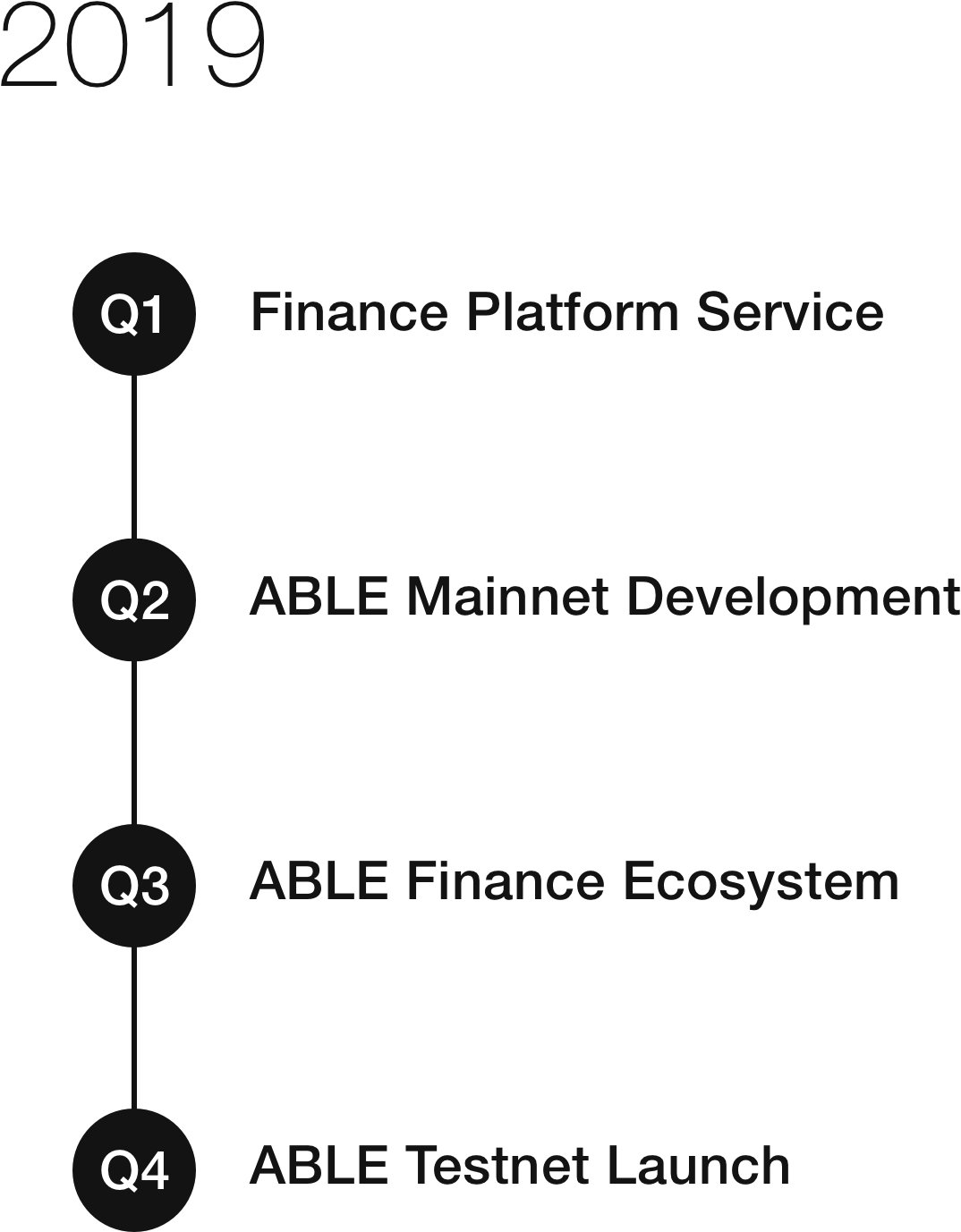

ROADMAP

CONCLUSION

The ultimate goal of ABLE is to provide users with a great user experience, while simultaneously allocating value to ABLE through all the benefits described above. In finance, the project aims to create a systematic ecosystem and develop a better user-accessible system by applying blockchain technology to any area deemed necessary.

ABLE intends to integrate into one system all the financial solutions currently dispersed across the blockchain market, by offering a solution to existing banks’ problems, and an alternative to centralized deposit-lending systems. The P2P investing-lending system, which is the core of the ABLE project, is particularly significant because it creates personalized accounts for cryptocurrency assets. Existing micropayment and fund solutions suffer from numerous shortcomings due to the lack of an integrated account, and users have substantial trouble using those solutions. Additional solutions will be created in the integrated system to provide various services to users through their account designed for them.

For more detailed information, please visit the link below:

- https://www.able-project.io/

- https://www.able-project.io/data/AB_whitePaper_Eng_180502.pdf

- https://bitcointalk.org/index.php?topic=3159298.msg32659058#msg32659058

- https://t.me/ABLE_Project_EN

- https://www.facebook.com/ablecoinproject/

- https://twitter.com/Ablecoinproject

AUTHOR

Bitcointalk Username: Dewi08

Telegram Username: @ dhewio8

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=894088

Wallet address (eth): 0x53D1Ea8619E638e286f914987D107d570fDD686B

Tidak ada komentar:

Posting Komentar